Investing is an important aspect of building wealth and securing financial stability. While most people are familiar with traditional investment options like stocks, bonds, and real estate, there is another emerging form of investment that has been gaining popularity – art shares.

Art shares allow individuals to invest in a fraction of an artwork’s value, making it accessible to a wider range of investors. This unique investment opportunity not only provides financial returns but also allows individuals to diversify their portfolio and support the arts industry. In this article, we will dive deeper into why you should consider investing in art shares.

Overview of Art Shares

Before we delve into the benefits of investing in art shares, let’s first understand what they are. Art shares, also known as fractional ownership or equity art, is a concept where investors can purchase a percentage of an artwork instead of owning the entire piece. This makes investing in high-value artworks more affordable for individuals who may not have the means to purchase the entire artwork.

Art shares are typically sold through online platforms, auction houses, or galleries. Investors can own a portion of the artwork for a set period, and once the artwork is sold, they receive a return on their investment based on their ownership percentage.

How It Works

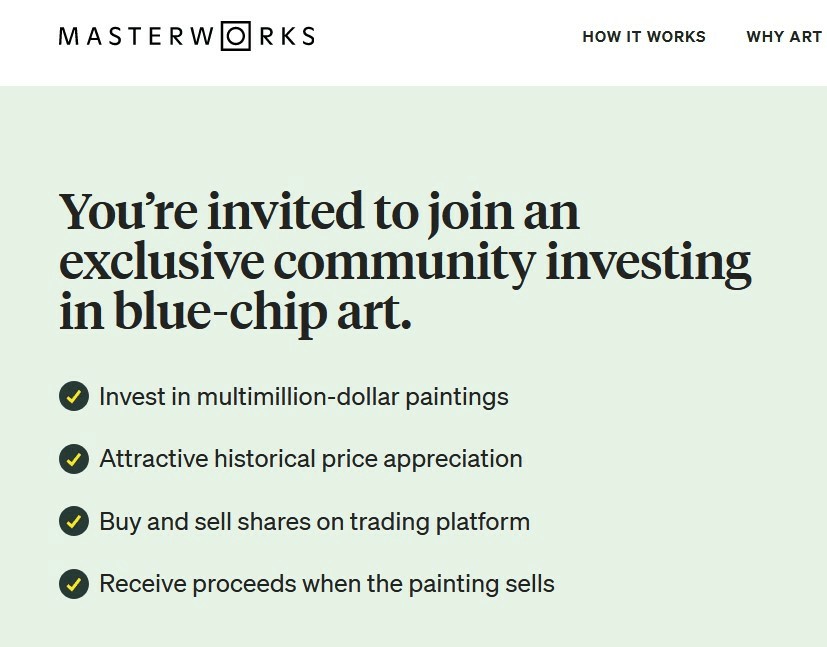

The process of investing in art shares is relatively simple. First, investors need to research and identify the artwork they want to invest in. This can be done through various online platforms such as Masterworks, Arthena, or Maecenas. These platforms offer a wide selection of artworks from renowned artists, allowing investors to choose which piece aligns with their interests and budget.

Once an investor has chosen the artwork, they can purchase a percentage of it, usually ranging from 1% to 20%. The initial investment amount can vary, with some platforms requiring a minimum of $1000, while others may require a higher amount. After purchasing the art shares, investors will receive regular updates on the artwork’s value and any potential dividends.

Benefits of Art Shares

Now that we have an understanding of how art shares work let’s explore five reasons why you should consider investing in them.

1. Diversification of Portfolio

Investing in art shares allows individuals to diversify their investment portfolio by adding an alternative asset class. Art has historically shown to have a low correlation with traditional investment options, such as stocks and bonds. This means that even if the stock market crashes, your art investments may still hold their value. By diversifying your portfolio, you can mitigate risks and potentially earn higher returns.

Additionally, art shares also allow individuals to invest in high-value artworks that they may not be able to afford on their own. This opens up new investment opportunities and adds diversity to an individual’s overall investment strategy.

2. Potential for High Returns

Art has proven to be a lucrative investment option, with the global art market reaching a record high of $64 billion in 2019. While investing in art shares does not guarantee high returns, it certainly has the potential for it. According to Masterworks, the average annualized return for their top 30 sold artworks is 32%, outperforming the S&P 500’s average return of 10% over the same period.

Furthermore, investing in art shares also allows individuals to invest in emerging artists who may have lower-priced artworks, but have the potential for significant growth in value. This provides investors with a chance to get in on the ground floor and potentially earn high returns in the long run.

3. Access to Exclusive Artworks

One of the main benefits of art shares is the opportunity to invest in exclusive artworks that are not readily available to the public. These can include pieces from renowned artists or highly sought-after artworks that are rarely put up for sale. By investing in art shares, individuals can own a portion of these artworks and potentially earn dividends when they are sold.

Additionally, by investing in exclusive artworks, investors can also contribute to the preservation and promotion of culture and history. Many platforms that offer art shares also have partnerships with museums or galleries, allowing investors to view the artwork they have invested in and be a part of its journey.

4. Liquidity

One major concern with investing in art is the lack of liquidity. Once an individual purchases an artwork, it may take years before it is sold at a higher value. However, with art shares, investors have the option to sell their shares on secondary markets, providing them with more liquidity.

Some online platforms also offer a buy-back guarantee, where they will purchase the shares back from investors after a certain period if they are unable to find a buyer on the secondary market. This provides investors with added security and the opportunity to liquidate their investment if needed.

5. Support for the Arts Industry

Investing in art shares not only provides financial benefits but also supports the arts industry. The pandemic has greatly impacted the arts sector, with many artists struggling to make a living. By investing in art shares, individuals can support emerging artists and help keep the arts industry alive.

Furthermore, art shares also provide investors with the opportunity to own and appreciate art without the high costs of purchasing an entire piece. This allows individuals to contribute to the cultural and historical significance of art while also benefiting financially.

How to Get Started with Art Shares

Now that you understand the benefits of investing in art shares let’s explore how you can get started.

1. Do Your Research

As with any investment, it is crucial to do your research before diving in. Take the time to understand the different platforms that offer art shares, their fees and minimum investment amounts, and the selection of artworks they have available. This will help you make an informed decision and choose the platform that aligns with your investment goals.

2. Diversify Your Investment

As mentioned earlier, diversifying your portfolio is essential in mitigating risks and maximizing returns. While investing in art shares can provide high returns, it is always wise to spread your investments across different asset classes. This way, even if one investment does not perform well, you still have others to fall back on.

3. Consider Your Time Horizon

Investing in art shares requires a long-term approach as artworks may take years to appreciate in value. Before investing, consider your time horizon and whether you are willing to keep your funds locked in for an extended period. If you need quick access to your funds, then art shares may not be the best option for you.

FAQs on Art Shares

What is the difference between art shares and buying an artwork?

When purchasing an artwork, an individual owns the entire piece and is responsible for its storage, maintenance, and potential resale. On the other hand, art shares allow individuals to own a percentage of the artwork without any of the added responsibilities.

How do I make money from art shares?

Investors can make money from art shares through dividends when the artwork is sold and through potential appreciation in value over time.

How do I know if the artwork I am investing in is authentic?

Art shares are typically sold through reputable platforms that work with established galleries and auction houses. These organizations conduct thorough research and authentication processes to ensure the authenticity of the artwork before offering it for sale.

Can I sell my art shares anytime?

While some platforms offer a buy-back guarantee, most art shares have a lock-in period where investors cannot sell their shares until the artwork is sold. However, investors can sell their shares on secondary markets if they need to liquidate their investment.

Are there any fees associated with art shares?

Yes, art shares come with various fees, such as management fees, transaction fees, and insurance fees. It is essential to understand these fees before investing to ensure you are making an informed decision.

Conclusion

Investing in art shares provides individuals with a unique opportunity to diversify their portfolio, potentially earn high returns, support the arts industry, and own exclusive artworks. While it may not be suitable for everyone, it is certainly an option worth considering for those looking to expand their investment options. With proper research and a long-term approach, art shares can be a valuable addition to any investment portfolio.

To learn more about art shares and other investment opportunities, visit lethuan.net.